Central Bank Digital Currencies- What are they ? | Episode #26

A primer to understand CBDCs, use cases and more

There’s been a lot of noise in recent times around RBI introducing CBDCs of their own. This is what a state minister in the finance ministry has to say on the topic - Government has received a proposal from Reserve Bank of India (RBI) in October, 2021 for amendment to the Reserve Bank of India Act, 1934 to enhance the scope of the definition of ‘bank note’ to include currency in digital form. RBI has been examining use cases and working out a phased implementation strategy for introduction of CBDC with little or no disruption.

Interestingly, a lot of founders are almost counting in this and already planning to introduce products around the same.

Note – In case you are a fintech founder, looking to raise funds, I might be able to help. Reach out to abhishek@indiafintech.in. In case you are looking to invest in Indian Fintech, reach out. Would be happy to help.

So, what is CBDC?

A CBDC is an electronic form of central bank money with potential wide use by households and businesses to store value and make payments. It is central bank digital money in the national unit (e.g., the US dollar) representing legal tender with the liability of the central bank, similar to physical currency in circulation. This makes CBDCs more secure and less volatile than other digital currencies.

CBDC is usually

Traditional money, but in digital form

Issued and governed by a country’s central bank

Influenced in terms of supply and value by a country’s monetary policies, trade surpluses, and central bank

Based on a digital ledger, and may or may not leverage blockchain or distributed ledger technology

And probably, just to make it clear, CBDC is not –

Cryptocurrency (like Bitcoin) governed by distributed autonomous communities instead of a centralized body

Value-dependent and determined entirely by the market; or

Equivalent to electronic cash (e.g., balance in a digital wallet or a prepaid card) with claim against an intermediary such as a commercial bank

CBDCs are rapidly evolving, and different central banks can take different approaches in implementation.

What exactly is the need for CBDCs?

The need for CBDCs is driven by the rapid digitization of economies, push for real-time payments and settlement, and need for more efficient domestic and cross-border monetary interactions. According to the International Monetary Fund (IMF), centralized technology such as CBDCs can reduce expenses, facilitate seamless flow of money, improve financial inclusion, and provide safer access to money through digital channels. On the other hand, many central banks are also realizing the increasing influence of digital currencies and are concerned about potential impacts on the financial system.

CBDC can be broadly divided in two major categories based on usage within a country’s financial and monetary ecosystem –

Wholesale CBDCs

This category of CBDC is generally used for trade between the central bank and public/private banks within a country. Payments using CBDC help in the reduction of risks related to liquidity and counterparty credit.

This space is one of the most important uses of CBDC as it helps in making the whole financial system of the country faster, safer, and economical. In the Indian context, it will allow the RBI to interface faster with and among its intermediaries and help in improving the existing real-time gross settlement (RTGS) system that is used in the current systems.

Wholesale CBDC can facilitate cross-border transactions between the wholesale CBDC systems of multiple countries, which is achieved by creating a corridor network or ‘bridge’ with an operator node run jointly by the central banks of the participating countries that issue the depository receipts. It helps in making the cross-border settlements across the participating central banks much faster and safer.

Retail CBDC

This category of CBDC acts as the digital format of the fiat currency which is meant for the general public and used by ordinary consumers to conduct financial transactions for day-to-day activities. Usually, retail CBDC is based on distributed ledger technology (DLT), like a private blockchain network handled by the government which helps it to trace transactions while maintaining anonymity. It also helps mitigate the involvement of private parties, thus preventing any criminal activity, like money laundering or fraud.

Retail CBDC can be issued directly to the public by the central bank. This form of issuance is called direct issuance. Alternatively, retail CBDC can be issued to intermediaries (which can be public/ private banks) who then issue it to the public much like a fiat currency. This method of distribution forwards the counterparty risk towards the regulated intermediaries and is called indirect issuance. A third issuance methodology, called hybrid issuance, can also be followed, in which retail CBDC is issued to intermediaries, as in the case of indirect issuance. However, in the case of hybrid issuance, the central bank periodically updates its own ledger with the retail balance records.

Infrastructure design considerations for CBDCs

CBDCs are mostly built on DLT, but evolving research suggests the feasibility of hybrid architecture. The choice of technology, however, depends on the CBDC design. Retail CBDC models are more suited for account based models, allowing users to create accounts with the central bank or intermediaries to receive CBDC. Such a design must be easy to use and access and can be open instead of permissioned. This would allow private entities to develop products and services over the network in an easy manner.

Wholesale models, on the other hand, can use tokens to create a wholesale payment network and increase efficiency. This infrastructure does not have the adoption, scaling and regulatory complexities that retail CBDC infrastructure does. There are also general use models, which can be used for both wholesale and retail issuance.

In the case of retail CBDC, central banks must also consider if the CBDC will be issued directly, indirectly or in a hybrid manner. A central issuance model allows the central bank to retain control of the underlying CBDC network. However, it has to be implemented within an ecosystem of commercial banks, financial institutions and service providers. The network can also lead to disparity in security, distribution and data privacy, as private parties can design their own access bridges to the network. The central bank would also have to bear overhead cost and network responsibilities in the direct model.

Key principles/considerations for CBDC in India

There are broadly three consideration when launching a CBDC. :

First, CBDC is not about overturning and making a new start. It needs to co-exist with the current payment system as a creative supplement to promote the establishment of a universal payment standard.

Second, CBDC is not a simple digitization of fiat currency. It has to be people-oriented, provide users with better payment experience that is privacy-protected, secure and reliable.

Third, CBDC does not pursue expansion in quantity and scale, but focuses more on the penetration and change of usage habits, steering the development of Internet finance back to the traditional financial ecosystem.

So, effectively, it needs to be co-existent with paper money, needs to provide innovation led incremental benefits and finally, CBDCs just cannot be about scale, it needs to focus on the “why” part of digital currencies.

What has happened on CBDCs till date?

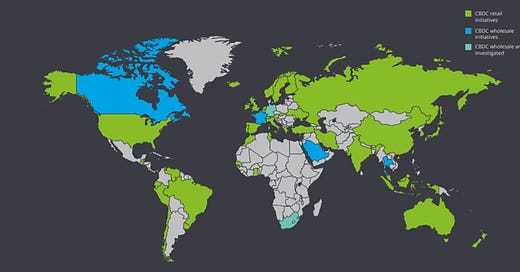

Currently, more than 60 central banks are talking about CBDCs, 36 of them are exploring both retail and wholesale CBDCs and 18 of the 60 are focusing solely on retail CBDCs.

In terms of stages of deployment, Bahamas is the only country to have implemented the CBDC (Sand Dollar). It is for use only in domestic transactions and cannot be used for cross border payments.

Interestingly, this is what they say on the currency -

Sand Dollar is not a cryptocurrency (e.g. Bitcoin). Sand Dollar is a central bank digital currency (CBDC), this means it is a centralized, regulated, stable, private and secure unit of account and means of exchange. The digital B$ is a direct liability of the central bank, in The Bahamas, backed by the foreign reserves. Cryptocurrencies are private sector issued or minted. While they may be backed by other assets, including central bank currencies, they may not represent the liability of any government or central authority. In some cases, cryptocurrencies may also not be backed by any underlying asset.

It lists Near instantaneous validation of transactions/real-time transactions processing as it’s key objective, amongst other things. This is a good resource on the same.

Most other countries, as shown below, are in various pilot and analysis phase.

Use Cases for CBDCs

CBDCs can be instruments that support the public policy objectives of the government by providing a safe and resilient means of payments. They promote efficient, inclusive and innovative payments if properly monitored, and the risks involved are overcome through effective means.

Some of the interesting applications of CBDCs could be –

Increased transparency in social benefit programs given high level of transaction visibility

Fast, real-time cross border remittance of money and reduction of time required for receiving payments across borders

Alternative secure payments for retail transactions which are instantly settled and lower risk in clearing of payments

Accurate risk profile of borrowers, faster disbursement of loans, accurate tracking of loan usage in terms of MSME lending

So, there are some real uses for sure! However, there are some real risk factors as well, the most important of them being state surveillance.

Another key risk I see is the risk of exclusion. In a country like India, where around 550 million people still use feature phones, it is important for CBDC to not only cater to the tech-savvy youth, but also to include feature phone users and people from lower socioeconomic groups within the country. Another 845 million people have smartphones, out of which many still don’t use mobile banking or digital payments in their daily lives. There are a plethora of reasons for exclusion to occur in the case of something like CBDC. These can range from economic factors, lack of knowledge, propensity of people in tier-2 or tier-3 cities to use cash, and unawareness of the existence of CBDC in some markets.

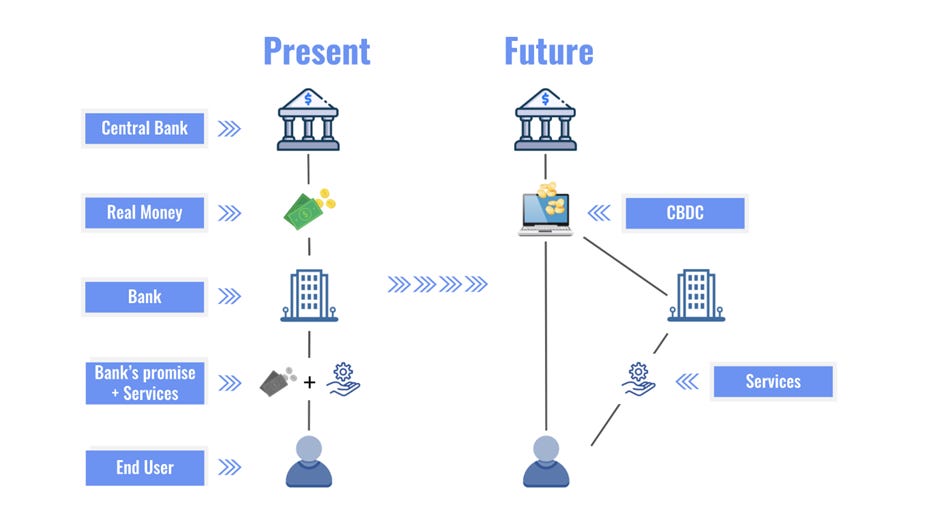

Another key risk I see happening is the disintermediation of Banks. What exact purpose would a bank serve if there is direct money transfer and direct credit transfers?

How would the transfer happen and also, how would the interest rate works and so on and so forth. Overall, the banking system is set for a serious disruption, as can be seen above.

Cyber attacks and hacks would be a problem as well in this system. Overall, the risks are in the face while the benefits are, at best, incremental in nature!

So, what’s next for CBDCs in India?

The Cryptocurrency and Official Digital Currency Bill, 2021, is scheduled to be introduced in the ongoing winter session of Parliament. As per RBI’s own admission - A CBDC is the legal tender issued by a central bank in a digital form. It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency. Only its form is different.

What it essentially means is that overall, the thought process behind CBDC is at its infancy and a real launch is pretty far away. What it also means is that while CBDC, if and when launched, will use DLT, but will not be a crypto currency! Also, there would be a need to develop a parallel payment rails for CBDCs which will work in parallel with current payment rails (NEFT, RTGS and the likes).

Overall, cons at this moment, including monetary risks and risks to the overall banking system ensures that it is some time from being a reality.

Hirings in Fintech

Paytail is looking to hire for multiple positions, including growth and B2B marketing. Please reach out to me and will connect with the founders.

Xpresslane is looking to hire a Sales and Marketing Head. Super interesting role with good equity on offer. Reach out to me on abhishek@indiafintech.in and will connect with the founders.

Nimbbl is hiring for multiple positions. Reach out to co-founder, Anurag here.

M2P Fintech is hiring for multiple positions, including a product manager. Reach out to Franklin for this role.

Antrepriz is looking to hire for multiple roles, including growth head, partnerships and more. Reach out to me and will connect with the right person.

Kudos is hiring for a business analyst and a graphic designer. Reach out to either me or the founder, Pavitra here.

Some of the interesting happenings in the Fintech Industry

Uni cards, which offers pay later cards, raised $70 mn led by General Catalysts. BNPL, in any format, is getting lapped up by investors. Interesting times ahead for the sector.

Open, the neobanking platform backed by Google, has announced acquisition of Finin, one of India’s first consumer-facing neobank.

Payments technology platform Juspay has scooped up $60 million in its Series C round led by SoftBank Vision Fund 2 with participation from existing investors VEF and Wellington Management

LegalPay, a New-Delhi based alternative-investments platform specialising in legal financing investments, raised an undisclosed Pre-Series A led by marquee investors including Venture Catalysts and Amity Technology Incubator.

FlyFin, a US fintech provider, announced that it raised $8 million total in a seed and pre-Series A round. Its namesake offering, FlyFin is the first A.I.-powered tax engine that combines the human expertise of CPAs to deliver a cutting-edge, mobile-first solution for individual and self-employed tax preparation and filings. Accel Partners led the round, with Falcon Edge (Alpha Wave Global) participating. FlyFin will use the $8 million in funding to accelerate its growth and enhance product development.

BookMyForex, India’s largest online foreign currency exchange platform, was recently selected to participate in RBI’s regulatory sandbox with the theme of cross border payments. As part of the regulatory sandbox, BookMyForex has started testing an alternative method of transferring funds online to overseas beneficiaries. Customers can simply enter the Visa Debit Card number of their recipient abroad instead of getting cumbersome details such as the customer’s foreign bank name, address, account number, SWIFT/BIC code, sort code/transit code etc.

Top Fintech news across the world