Episode 2 – Fintech - New age consumer credit card players upping their game!

Interesting times for the credit market overall!

Been hearing a lot of interesting stuff around Slice’s new credit card for everyone with a limit of just Rs. 2,000. This opens up a lot of new TAM and is a food for thought for the existing large credit card players, including the incumbents SBI Cards, HDFC and ICICI, among others. This corresponds to a credit limit of $27. Compared to this, the average limit in Indian credit market is at $1450 – This is huge!

Slice , which has been lately disbursing as many as 100,000 new supercards — its marquee offering — to users each month, is not charging any joining fee or annual fee with its new card and is offering the same benefits as its supercard.

Slice, a Bangalore-based startup, believes it has found the solution. The startup, which has years of experience in issuing its cards to young professionals with no traditional jobs, said on Wednesday it’s launching a card with 2,000 Indian rupees ($27) as the default limit to tap the nation’s potential addressable market of 200 million individuals.

The startup, which has been lately disbursing as many as 100,000 new supercards — its marquee offering — to users each month, is not charging any joining fee or annual fee with its new card and is offering the same benefits as its supercard. The startup is able to offer this card to users because it has spent years building its own credit underwriting system that supports this. Interestingly, they don’t use the CIBIL or other credit score!

Now, there are a handful of companies doing the consumer credit card compared to a swarm of those doing the B2B2C stuff. Galaxycard, which last raised $450K in 2021 offers smartphone linked credit card to consumers.

One card recently raised $10 mn from the likes of Sequoia and Matrix Partners. One card has a unique proposition of a metal card, no joining fees and no yearly fees. They do instant online card approvals and have garnered quite a bit of followers among young credit card users. Their average credit limit is $2,000+. Another startup trying to disrupt this market is the vCard which raised $300K some time back.

However, partnerships with banks remains a major roadblock here – One card has tied up with IDFC First bank and SBM. Also , credit card network is another challenge – Slice has tied up with Visa and I just applied to them. Will update the experience here.

Why the sudden interest in this segment?

Direct to consumer, unsecured loan is hard as evidenced by even the largest of players like HDFC Bank which saw large delinquencies in 2007-08 period and scaled back the speed of new card issuance significantly. The huge population with no access to credit cards and the lure of easy customer acquisition is gathering velocity and few startups do want to capture the trend.

Even as there are hundreds of millions of Indians who have bank accounts, only about 30 million of them have credit cards. The adoption rate of the plastic card has largely remained stagnant in the South Asian nation for the last few years.

The relatively young credit-rating system in India covers only a tiny fraction of the nation’s population. And banks neither have sophisticated underwriting systems nor the risk appetite to make any attempts to move the needle.

As per Nomura reports, credit card holders represent just 3% of unique population and less than 10% of people holding CIBIL score.

Also, over a long period, the expectation of a strong, ~15% CAGR in card holders and ~18-20% increase in card spends is anticipated.

Even in terms of household credit to GDP , India is one of the most conservative countries and this represents a major opportunity, a huge population set, waiting to be served.

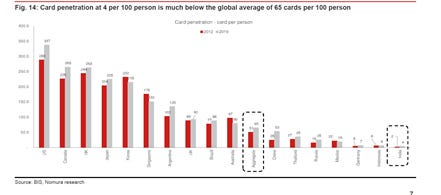

Card spends to GDP is at just 4% compared to ~17% globally and also, card penetration at 4 per 100 person is not even at 10% of global average of 65 cards per 100 persons! The interesting thing here is that credit card penetration has increased to 4.5% from just 1.9% in 2016. Also, since demonetization, card holders have increased at a pace of 24% CAGR and card spends at 32% CAGR – The industry is set to become huge. The recent SBI Cards listing success points towards the same.

Overall, payment infrastructure in India is seeing marked improvement in recent times and this bodes well for the overall credit system in the country.

There is an interesting shift happening in the personal credit card market. Players like Slice have started previously untouched population due to lack of credit scoring and that in itself is huge. Also, the taxpayer pool (relevant for higher limit credit cards) is expanding with +11% , CAGR over FY12-18 with >0.25mn income bracket growing at even a stronger pace of ~23% CAGR. Overall tax filers still remain low at just 5% of the population and taxpayers (income levels >INR0.25mn) are just 4% of the population. That said, the share of taxpayers within tax filers expanded from 45% in FY12 to 60% in FY18. More importantly, the INR0.25-0.50mn income bracket and >INR0.5mn income bracket recorded 21% and 24% CAGR, respectively.

Credit card issuers have also started issuing lower income threshold cards, which should help in expanding the target card market. Further, new segments like BNPL and UPI will only help expand the market as customers upgrade to credit cards, seeking higher credit.

Interesting times for the credit market overall!

Latest news in Fintech

Indian fintech Slice launches $27 credit limit cards to tap 200 million users | TechCrunch

Lightspeed-backed Dukaan raises $11 Mn in pre-Series A round (entrackr.com)

R S Software acquires stake in its Indian subsidiary 'Paypermint'; Stocks up 1% (indiainfoline.com)

Neo-banking platform SaveIN raises funds in extended pre-seed funding round (livemint.com)