Gold Loans – More than secured lending, Lending Fintech’s holy grail? | Episode #29

SahiBandhu, Rupeek, IndiaGold, Ruptok, Federal Bank..the list goes on

It’s interesting I am writing about Gold backed loans in this newsletter. After all, what’s new about gold loans? They have been here for a long time, there are listed companies like Muthoot Finance/Manappuram Finance which are behemoths and then there’s SBI (yes, the bank) and HDFC Bank, doing more gold loans than anyone else.

Turns out, there is whole lot of new lenders in this super secured lending space, propping up and trying to disrupt the market with significantly lower rates than NBFCs (they are thriving on services) and significantly better consumer journeys than banks (their selling point is lower rates). Effectively, they are bringing best of both the worlds, adding in their own USPs such as doorstep delivery and pickup (which solves for the biggest issues in gold loans – social sitgma) and creating a super attractive market for themselves. SahiBandhu, Rupeek, IndiaGold, Ruptok are some of the leading players in the space.

What’s even more interesting is that since loans are usually maximum at 75% LTV, unless gold prices crashes by more than 20-25% and people suddenly stop caring about their gold jewelries, I see this as one of the strongest lending plays currently. Read on to get into the details of this interesting segment.

In terms of meeting some interesting founders, Paytail has been an eye opener. These guys are changing the way BNPL is viewed and targeting the long tail, 300bn offline retail market (everything apart from groceries and FMCGs). Clearly one firm where I am super excited and I do expect to do a deep dive on this soon. Another interesting firm we met this week is Symbo Insurance, which is one of the leaders in bite sized, micro-insurance. Interesting times ahead in the industry for sure.

Note – In case you are a fintech founder, looking to raise funds, I might be able to help. Reach out to abhishek@indiafintech.in. In case you are looking to invest in Indian Fintech, reach out. Would be happy to help.

Where exactly is the segment currently?

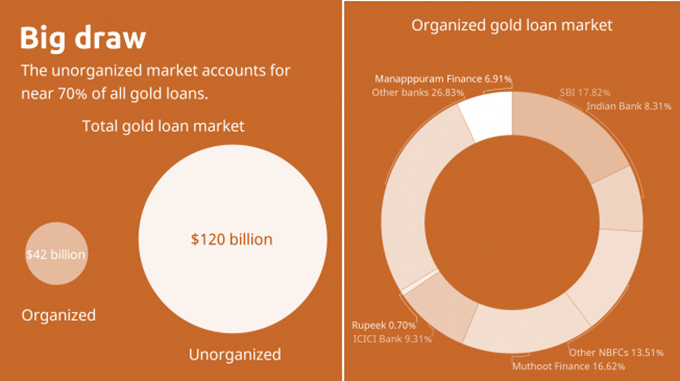

According to the World Gold Council, the gold loan market is projected to growth at an annual rate of 15.7 per cent to reach Rs 6 lakh crore in FY24.

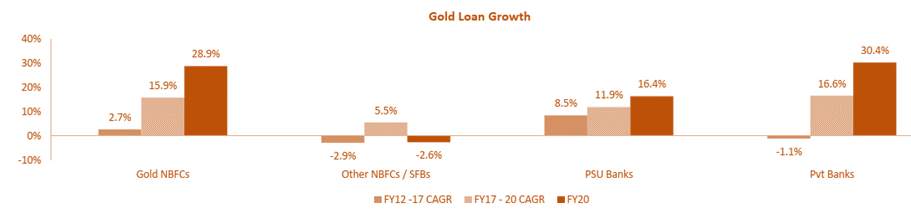

Organised sector has been growing very significantly and now corners 35% of the overall market, compared to just 24% in 2018. Gold loan growth for various players have been dependent on broadly two factors – ease of the entire process and interest rates/LTV considerations.

Source: Abhishek Kumar, TMC

Ease of access is what has made Muthoot Finance and Manappuram the two biggest gold loan NBFCs in India. Muthoot Finance recently hit Rs 50,000 crore in gold loan assets under management, whereas Manappuram’s gold loan assets crossed Rs 20,000 crore in the third quarter of 2020-21.

For banks, State Bank of India, the country’s largest public sector bank by assets, leads the pack. With its 20,000-odd branches across India, SBI has close to 18% of the gold loan market. NBFCs that specialize in gold, such as Muthoot Finance and Manappuram Finance, are not far behind though.

Among the banks, other than SBI, ICICI Bank, Federal Bank and several of the small finance banks have been aggressive in the gold loan segment recently. Here, ICICI Bank is particularly excited. Every single one of its 5,500 branches offers gold loans.

ICICI currently does Rs 600 crore disbursements every month, and the plan is to take it Rs 1,000 crore every month. Interestingly, Federal Bank recently started doing doorstep pickup of gold jewelleries as well as conducting the entire loan process at home.

Probably the only bank to do so – stepping on the fintech’s turf! And there is a strong reason for why this is important – biggest one being the fact that people don’t really feel like putting up their gold as a collateral. It’s a stigma to go to bank’s/nbfc’s branch, get the loan done. Usually, families do it while trying to keep it a secret – Players like SahiBandhu which are doing Rs.200Cr a month in loan disbursals, hit it right. Rupeek, of course, have nailed this as well.

Why can’t banks do Gold loan if it’s such a big, under-penetrated market?

Now, NBFCs usually charge ~20-22% annualized interest rates, while banks charge ~9-12%! Given that it’s a highly secured form of lending and repayment behaviors are significantly better than other segments, it’s surprising how banks have not been able to ride on this.

Banks fail in execution - Banks’ strategy is remarkably interesting. Their management remains very bullish on gold loans, but at branch level, managers are not excited. Bank employees are used to doing documentation processes required in personal loans, etc., but for gold loans they need to hire jewellers and every time there is a customer, they will call the jeweller to value the gold.

Now, gold loans are usually short term (3-7 months) and lower AOVs (20K-1L) and they need same amount of KYC work as larger loans – which leads to bank employees ignoring this segment. The problem with banks is they are only available for a few hours—like 2-3 hours a day—when it comes to offering gold loans. There are too many formalities like rigorous KYC that takes almost half a day, and small-ticket size and short-term loan is never a priority.

This is exactly where the current crop of gold loan NBFCs made a killing -they made the entire process super easy and super fast. Instead of spending a day or more at any bank, they started giving out loans in 20-30 minutes, albeit at higher rates. Now, since these are small tenure loans and payments are usually either interest only for EMIs and principle at the end, the difference in interest rates actually translated to few thousand rupees change in overall repayment – not many people realized how much more are they paying in % terms.

And this is where the fintech gold lenders are hitting now – They are trying to improve on the convenience by ensuring door step pick up and by tying up with banks, they are also reducing interest rates for end users – get loans at rates marginally higher than banks (12-15%), get the convenience of gold loan nbfc players and more.

A very strong moat indeed.

What am I most excited about?

Source: Abhishek Kumar

As it can be seen, Fintechs have only started here. There is a clear whitespace for a player who can come in, target traditionally non-targeted areas such as rural/tier ii cities and towns and create new markets for gold loans, primarily because even NBFCs and most of the fintechs have somehow focussed only on big cities.

The fintech startups have an edge here, along with their offers of lower interest rates.

The main costs to deal with are in customer acquisition, fulfilment and storage. When it comes to fulfilment costs, startups look to differentiate themselves; fulfilment costs are essentially spent on getting gold appraised, before the digital loan is issued. Interestingly, fintech’s costs, as per various claims, are around 1/10th of banks!

When it comes to gold storage, fintech lenders use either their bank partners or cash management services—which is a recurring cost that is somewhere between Rs 5,000 and Rs 55,000 every month for a loan, based on the volume of gold. Their costs eventually goes lower than those of NBFCs.

This is where I am super excited one player which you don’t hear about enough – Sahibandhu, part of Manipal business. They are probably the second largest fintech player in the country with an annual disbursement rate of Rs.3,000 Cr.

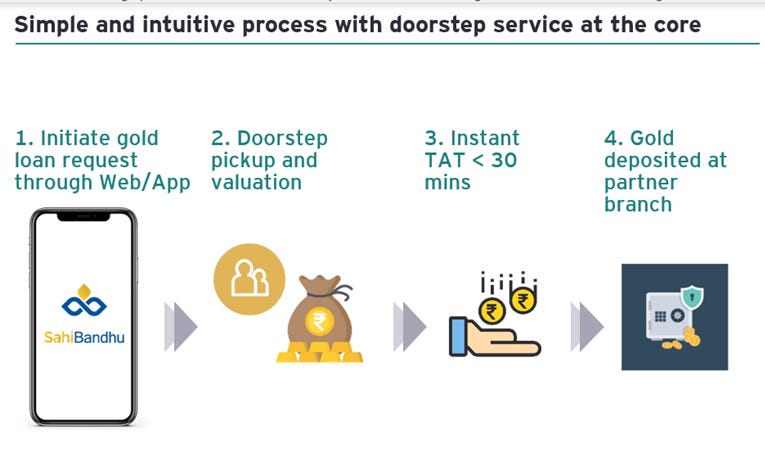

They have a very intuitive process which ensures TAT of <30 mins for loan disbursements. Interestingly, if you look at their website, they focus on trust and transparency more than anything else.

Given that they have interest rate tie ups with Banks such as ICICI Bank, HDFC Bank, Axis Bank, CSB Bank and others, combined with the reach and trust of Manipal as a group, I firmly believe they are the dark horse most likely to become leaders of the space. The following expands on my thought process here -

Source: Abhishek Kumar, TMC

If they are able to execute and the current numbers do indicate they can, it’s going to be super exciting.

Some of the smaller players such as Ruptok, have been scaling up well. They recently crossed Rs.100 Cr in total disbursements and with new fund raise, given the opportunities in the space, they will only move up.

Rupeek has been making waves and there is definite space for more than one/two players in the space, as the duo of Muthoot and Manappuram has shown us.

Rupeek - How do they work? A Case study

Rupeek commenced its operations in FY16 from Bengaluru. The main aim of Rupeek is to make gold loan cheaper for customers and provide superior customer service. Top-tier PE investors such as Sequoia Capital, Accel Partners, Bertelsmann India Investments and GGV Capital back it.

Rupeek offers gold loans at the customer’s doorstep and completes the loan underwriting-to-disbursal process within 30 minutes. With an online-only strategy, Rupeek offers gold loans at low interest rate (starting at 0.89% per month). While Rupeek has a non-banking financial company (NBFC) license, it primarily lends through its banking partners and not from its own book and has around 15 major banks, including both the largest PSU and private bank, on board as lenders across various levels of integration.

As such, Rupeek is operating as more of a gold finance distributor now, which opens up significant potential considering limited capital requirements for such business.

If one looks below - they pivot on three factors - low interest rates, convenience and safety. That’s what this business is all about!

They offer gold loan in 4 easy steps:

Step 1: Customers can apply via phone number. Rupeek’s representative calls within 5 minutes to help customers.

Step 2: Rupeek’s representatives visit customers’ home or office at customers’ convenience wherein the representative will complete all the formalities such as KYC, appraisal of gold etc.

Step 3: Upon completion of formalities, loan amount gets transferred to customers’ account before Rupeek’s representative leaves.

Step 4: Afterwards, the representative will store the gold at the nearest partner banks’ branch and safety vault. Gold is 100% insured which is free to the customer.

Rupeek is one of the best-rated gold loan applications on Google play store in India. It has a rating of around 4.6 on play store with over 100,000 downloads and over 17,000 reviews. After starting its operations in Bengaluru, the company has diversified into 30+ cities serving over 500,000 customers.

So, what’s next?

Think we will see creation of multiple large business here, each focusing on separate user segments as well as geographical ones.

See good investments in the space as well. Exciting times ahead for sure.

Hirings in Fintech

Paytail is looking to hire for multiple positions, including growth and B2B marketing. Please reach out to me and will connect with the founders.

Highradius, a SaaS firm for treasury, O2C and record to report is hiring for multiple roles in product, tech and sales. Please reach out to me in case you are interested.

Dice is looking to hire for multiple roles, including growth head, partnerships and more. Please reach out to me in case you are interested.

Xpresslane is looking to hire a Sales and Marketing Head. Super interesting role with good equity on offer. Reach out to me on abhishek@indiafintech.in and will connect with the founders.

Nimbbl is hiring for multiple positions. Reach out to co-founder, Anurag here.

M2P Fintech is hiring for multiple positions, including a product manager. Reach out to Franklin for this role.

Some of the interesting happenings in the Fintech Industry

Debt investor aggregator platform Wint Wealth has raised an exclusive/special round for an undisclosed amount from a cohort of financial influencers. The funding round saw participation from Nearbuy founder Ankur Warikoo, Finology Ventures’ Pranjal Kamra, marketfeed founder Sharique, stock market courses maker CA Rachna Ranade and 11 others.

StockGro, the Bengaluru-based social investment platform startup, has raised $32 million in Series A round of funding from BITKRAFT Ventures, General Catalyst, and Itai Tsiddon, who is the co-founder of Lightricks, an Israel-based unicorn. This round of funding also saw participation from its existing investors Roots Ventures and Creed Capital Asia. Besides, a syndicate of angel investors who are founders of Base 10 Capital, Junglee Games, Nazara Technologies, and Robinhood were part of this round.

Business accounting and inventory management application company Simply Vyapar Apps Pvt Ltd has raised $30 million in a Series B round of funding led by WestBridge Capital. Returning investors IndiaMart and India Quotient also participated in the round. Fortytwo.vc also participated in the round, said a statement issued by the company.

There’s a new fintech VC in town! White Venture Capital, launched by IPO-bound Pine Lab’s founder Amrish Rau, fintech Jupiter’s Jitendra Gupta and managed by angel investor Sweta Rau. The fund, with a corpus of $40 Mn, will back fintech startups across India and Southeast Asia. It will write cheques of $250K – $1 Mn in seed to Series A rounds, with follow-up investments worth $2 Mn- $3 Mn.

Raise Financial Services, the fintech startup founded by Paytm Money's former chief executive officer Pravin Jadhav, has raised a $22 Million in its Series A round led by BEENEXT and Mirae Asset Venture Investments. The financing round also saw participation from 3one4 Capital along with Rocketship.vc.

Bengaluru-based crypto startup, Flint, has raised a $5.1 million seed round led by Sequoia Capital India and GFC. Coinbase Ventures, Hashed, IOSG, Better Capital, Antler India and MSA Capital also participated in the round as part of 11 institutional investors.

Other news in the industry

Morgan Stanley Asia (Singapore) Pte, one of every of the lead managers of the initial public giving of One97 Communications Ltd, the parent company of Paytm. It has sold-out a considerable portion of its stake within the firm, the newest information on the holding pattern revealed.

nice informative article Abhishekji... i need to connect more on this plz share connect detail..