Insurtech In India: The landscape, tailwinds and the white spaces | Episode 47

Despite being the world's most populous country with an increasingly digital consumer base, India continues to be deeply underinsured. Time to change this.

Imagine a country where nearly every citizen carries a smartphone, digital payments flow seamlessly, and technology has revolutionized everything from grocery shopping to education—yet when it comes to protecting their homes, health, or livelihoods, people are left with antiquated, opaque systems that feel like relics from another era. Welcome to India's insurance paradox.

Despite being the world's most populous country with an increasingly digital consumer base, India continues to be deeply underinsured. The numbers speak for themselves: insurance density in India is just ~$91 compared to a global average of ~$800, and penetration (as a share of GDP) hovers around 4.2% --- with life insurance making up 3.2% and non-life only 1.0%.

When you walk the streets of Mumbai or Bangalore, you'll find tech-savvy consumers who use UPI to pay street vendors and book cabs on apps—yet these same individuals often lack basic health coverage or protection against common risks. This disconnect isn't merely a statistic; it represents millions of families one accident or illness away from financial devastation. We, at UNLEASH, are looking for founders solving in this space keenly.

Historically, the sector has suffered from legacy inefficiencies- high distribution costs, lack of transparency, poor claims experience, and low awareness.

But over the past few years, a new wave of technology-first startups --- India's insurtechs --- have begun rewriting the script.

These aren't just digital versions of traditional insurance companies. They are category creators - using digital infrastructure, embedded distribution, and AI-powered risk tools to create insurance that is faster, more accessible, and more relevant to India's diverse population. And the transformation has only just begun.

In this episode of Indiafintech, we take a 360-degree view of this rapidly evolving ecosystem - from embedded insurance and API-led underwriting to catastrophe reinsurance and parametric covers and talk about the white spaces where large outcomes are possible.

This is a Rapidly Expanding Market

The Indian insurance industry is expected to grow from ~$150 billion in FY24 to over $350–400 billion by FY30, clocking a compound annual growth rate (CAGR) of ~15%. But what’s more exciting is the digital portion of this pie. Today, insurtech-led distribution accounts for only $4–5 billion, but this is forecasted to explode to $30–40 billion by the end of the decade — growing at an estimated 35–40% CAGR.

The sector has seen ~USD 2.1 bn VC/PE investment in the last 5 years across various stages. And the pace of investment across early stage has only increased in the recent times.

This acceleration is driven by a convergence of forces: regulatory reforms, mass digitization, embedded insurance use cases, and the rise of a mobile-first, millennial consumer base.

Digital-first models, smarter distribution, and the rise of contextual coverage are driving this exponential growth in the insurtech segment. In many ways, this is a “Jio moment” for insurance — access, affordability, and ease-of-use are reaching the masses for the first time.

There are four main Forces Driving India's Insurtech Boom

1. A Bold, Progressive Regulator

Contrary to the stereotype of Indian regulators as conservative gatekeepers, IRDAI has emerged as one of India's most innovation-friendly regulators. It's not only allowing digital-first insurance models to flourish but is actively nudging the sector forward with initiatives like:

Insurance for All by 2047 - a moonshot vision of universal access to life and health cover that echoes the ambition behind India's digital public infrastructure.

Bima Sugam - a government-backed digital marketplace aiming to simplify discovery, comparison, and portability across insurers. Think of it as the UPI of insurance—a fundamental infrastructure layer that could accelerate adoption.

Regulatory sandboxes, relaxed FDI limits (now 100%), and lower capital thresholds for digital-only players.

When IRDAI chairman Debasish Panda spoke of "insurance for all by 2047" last year, he wasn't just announcing a policy goal—he was signaling a paradigm shift. In the corridors of power, insurance is increasingly viewed not as a luxury product but as a fundamental financial tool for resilience and economic security.

Much like how UPI democratized payments, Bima Sugam could be a watershed moment for insurtech --- enabling API-driven access to insurance much like PhonePe or Google Pay did for bank accounts.

2. Embedded Insurance is Changing the Distribution Game

Remember when buying insurance meant sitting through hours of agent presentations or navigating confusing paperwork? That world is rapidly disappearing.

Traditional insurance relied on agents and cold calls. Today, insurance is increasingly bundled at the point of experience, on an Ola ride, a Zomato order, or a Flipkart checkout. This "invisible insurance" model removes friction and dramatically lowers customer acquisition costs.

Picture this: a delivery rider in Patna accepts an order on a food delivery app. With a single tap, he activates accident coverage for the duration of that delivery. No forms, no calls, no separate premium payment—just contextual protection when it matters most.

What's powerful here is not just the convenience but personalization and timing --- users get relevant protection when they need it most.

The winners here won't be those with the best product but those with the best distribution rails --- whoever controls the transaction flow controls the insurance hook.

In this new paradigm, insurance isn't something you buy—it's something that comes built into the experiences and products you already use.

3. India's Digital-Native Consumer Base

The average Indian insurance buyer today bears little resemblance to their counterpart from even five years ago. They demand instant service, transparent pricing, and digital-first interactions.

India's massive digital population --- over 825 million internet users --- is no longer confined to metros. The rise of vernacular content, regional fintechs, and mobile-first habits makes insurance more accessible than ever.

Travel to a town like Jhansi or Jorhat, and you'll find shopkeepers using digital payment systems and young professionals scrolling through financial apps. These aren't just tech-savvy early adopters—they represent mainstream India, and they're bringing their digital expectations to every financial service, including insurance.

The new-age consumer expects:

Zero paperwork

Instant policy issuance

Transparent claims

Insurtechs are uniquely positioned to meet these expectations.

Traditional insurers built for an analog era are struggling to adapt, creating what venture capitalists call "insurgent advantage"—where the lack of legacy systems becomes a competitive edge for startups.

4. Data and AI-Powered Risk Intelligence

Insurance has always been a data business, but the types of data and how they're analyzed are undergoing a profound transformation.

With IoT, wearables, and real-time data integration, insurers are increasingly shifting from actuarial tables to individualized risk scoring.

Underwriting is becoming more precise, fraud detection more intelligent, and claims more seamless --- reducing operational costs and improving margins.

Consider a young driver in Pune who installs a telematics device in his car. Rather than paying premiums based on broad demographic categories, his rate adjusts based on his actual driving patterns. Safer driving means lower premiums—creating a virtuous cycle of risk reduction and cost savings.

In the next few years, AI-native insurers (those with in-house data science and automation engines) will outperform those relying on legacy partnerships or outsourced stacks.

The frontiers of this technological revolution extend beyond customer-facing applications. Behind the scenes, machine learning algorithms are revolutionizing everything from fraud detection to portfolio optimization.

The Evolving Insurtech Landscape: Business Models in Motion

Walk into any startup hub in Bangalore or Gurugram and you'll hear founders pitching insurtech models that would have seemed far-fetched just years ago. India's insurtech market is diverse and rapidly maturing. Startups are not just digitalizing old models --- they are redefining how, where, and why insurance is consumed.

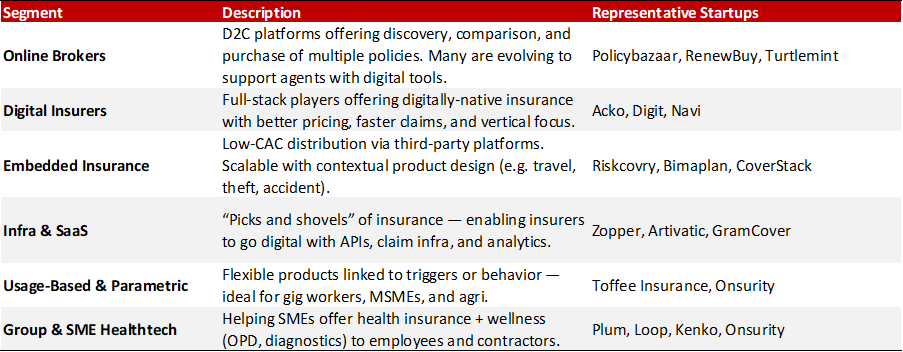

Some of the more well known names in the industry across various segments of the insurance value chain are as follows -

These startups aren't just competing with each other—they're increasingly forming a symbiotic ecosystem. An embedded insurance API provider might power a digital insurer's distribution, while a parametric specialist could leverage a SaaS platform's risk analytics.

The taxonomy above captures the current landscape, but the boundaries are increasingly fluid. Today's online broker might be tomorrow's infrastructure provider, and yesterday's group health startup could evolve into a full-stack digital insurer.

As regulatory and customer barriers drop, infrastructure-led B2B plays and embedded B2B2C platforms could dominate the next investment cycle. Interesting opportunities should arise here for investors.

What's particularly exciting is how these models are adapting to uniquely Indian realities—from creating microinsurance products for rural farmers to designing special coverage for the country's massive gig workforce.

Leaders of the Pack: The Most Funded Players

Behind every insurtech success story are ambitious founders and forward-thinking investors who saw opportunity where others saw only challenges. The funding landscape reveals which models have gained the most traction—and investor confidence. In all fairness, almost all models have seen serious funding in the space with most investors looking to invest into founders who demonstrate an intention/ability to do manufacturing themselves.

These startups represent the breadth of India's insurtech thesis --- urban retail, SME health, Tier 2 agency models, and rural microinsurance.

Each company tells a different story about India's insurance evolution. Acko pioneered the direct-to-consumer digital insurance model, creating seamless digital experiences for urban millennials. Meanwhile, Turtlemint recognized that human agents wouldn't disappear but could be empowered through technology—creating a hybrid "phygital" model that works particularly well in Tier 2 and 3 cities.

Digit's success demonstrates how customer-centricity and claims simplification can transform traditional insurance categories, while Plum and Onsurity are making employee benefits accessible to startups and SMEs that were historically priced out of the group health market.

The success of these companies isn't just measured in valuation milestones. Their true impact lies in how they're expanding the insurance market—creating new categories, reaching underserved segments, and redefining what protection means for a digital-first generation.

Capital Flows: Where the Money Is Going

The flow of venture capital tells us not just about current winners but about where smart money sees future opportunity. The funding patterns in Indian insurtech have evolved significantly over the past few years.

The evolution of these funding trends tells a story of market maturation. The early days of insurtech funding were dominated by headline-grabbing rounds for consumer-facing brands. Today, investors are increasingly betting on infrastructure plays, embedded models, and specialized vertical solutions.

When Acko and Digit raised massive rounds in 2021, it signaled investor confidence in full-stack digital insurers challenging incumbents directly. The more recent focus on companies like Zopper (insurance infrastructure) and Bimaplan (embedded microinsurance) suggests investors now see greater opportunity in enabling the broader ecosystem rather than just backing standalone consumer brands.

Early winners have largely been consumer-facing. The next vintage of VC-backed insurtechs will likely be SaaS, infrastructure, and platform-first companies enabling the broader ecosystem.

This shift parallels what we've seen in other fintech categories, where infrastructure and enabling platforms often create the most sustainable value after the initial wave of consumer adoption.

What's Still Broken: Challenges That Remain

Despite the impressive growth and innovation, significant hurdles remain. Spend an afternoon in an insurance claims office or speak with first-time policyholders, and you'll quickly understand that the industry's transformation is still in its early stages. The following represents some of the broken problems, still to be solved, in my view-

These challenges aren't merely operational headaches—they represent fundamental barriers to achieving the sector's potential. The trust deficit is particularly concerning; negative claims experiences create ripple effects that discourage entire communities from embracing insurance.

Many insurtech founders can recount stories of integration projects with incumbent insurers that stretched from weeks to months, with layers of manual processes hiding behind supposedly "digital" facades. Breaking through these legacy barriers remains a significant challenge even for the most innovative startups.

A breakthrough in digital claims infrastructure or standardized API protocols could dramatically accelerate ecosystem integration.

The next frontier of innovation may well be in claims processing—the moment of truth in the insurance value chain. The company that can truly reimagine claims as a delightful, transparent experience could unlock enormous value and trust.

One topic usually often left behind is Reinsurance in India: The Engine Behind the Scenes,

Behind every insurance policy lies a complex web of risk transfer that most consumers never see. Often overlooked, reinsurance is the foundation of the insurance industry --- it absorbs tail risks, enables high-value underwriting, and ensures balance sheet solvency for primary insurers.

Reinsurance decisions shape which products get launched, how they’re priced, and ultimately who gets protected. Yet this critical component of the insurance value chain has received relatively little attention in the nsurtech narrative.

Market Snapshot of the Re-insurance market

The composition of this market reveals much about India's insurance evolution. GIC Re's dominance (with 50-60% market share) reflects the legacy of state control, while the growing presence of specialized global reinsurers signals increasing sophistication and product diversity.

As primary insurers get more aggressive and product innovation accelerates, India's reinsurance market will become more dynamic, segmented, and competitive --- finally moving beyond its public sector legacy.

The reinsurance relationship is evolving from a simple risk transfer mechanism to a strategic partnership. Global reinsurers bring not just capital but expertise, data, and global best practices that help domestic insurers navigate new risk categories.

What's Changing in Reinsurance

Parametric Covers: Automatic payouts triggered by rainfall shortfall or disaster metrics --- crucial for agri and MSMEs. Imagine a small farmer receiving an automatic payout when rainfall drops below a certain threshold—no claims process, no adjusters, just immediate financial relief when it's needed most.

Facultative Models: Large-ticket, complex policies increasingly require reinsurance support on a per-policy basis. This enables coverage for specialized risks that would otherwise be uninsurable.

Digital Reinsurtech Platforms: API-based platforms for pricing, placement, and retrocession are emerging globally --- India could see similar models soon. These platforms promise to bring efficiency and transparency to what has historically been a relationship-driven, opaque market.

Structured Health Reinsurance: COVID created demand for more nuanced, data-backed reinsurance of health portfolios. The pandemic exposed gaps in traditional reinsurance approaches, accelerating innovation in health risk transfer.

Challenges

The following changes still remain though -

These challenges reveal the growing pains of a market in transition. The regulatory preference for GIC Re created a quasi-monopoly that is only now beginning to open up. Meanwhile, the tendency of domestic insurers to cede excessive risk to reinsurers reflects both capital constraints and risk aversion—limiting the development of in-house underwriting expertise.

Perhaps most concerning is the data gap. Without robust actuarial history in critical areas like crop insurance, health risks, and natural disasters, both insurers and reinsurers struggle to price risks accurately. This leads to either excessive conservatism (making products unaffordable) or dangerous underpricing (threatening solvency).

What's Next: 2030 Predictions

When we look ahead to 2030, we see an insurance landscape fundamentally transformed—not just digitized versions of today's products but entirely new protection paradigms built for a digital-first India.

IPO wave: Since the Digit IPO, there has been quite a lot of interest from other scaled players to go public. Acko and others may go public, creating benchmark valuations.

Bima Sugam rollout: If successful, it will be the UPI moment for insurance --- and spark mass market adoption. Just as UPI transformed how Indians pay, Bima Sugam could revolutionize how they protect themselves and their assets.

SME and rural expansion: Distribution rails via agri-fintechs, gig platforms, and BCs will create new growth vectors. The next 100 million insurance customers will come not from urban centers but from India's heartland.

Reinsurance-as-a-Service (RaaS): Indian startups could build the world's next retrocession engine. With its deep tech talent pool and growing insurance expertise, India is well-positioned to develop global reinsurtech platforms.

AI-native insurers: Expect new startups to be built around AI-underwriting and real-time pricing --- not legacy tech stacks. These companies will leverage India's AI talent to create insurance models that continuously learn and adapt.

Imagine walking into a small shop in rural Odisha where the owner can access customized business insurance through a simple app, or a construction worker in Chennai who receives automatic injury coverage when he clocks in at a worksite. These scenarios—impossibly futuristic just years ago—are becoming the new normal.

New opportunities areas

Basis the above, I see following key areas for diving deeper -

These opportunity areas aren't just theoretical—they represent tangible white spaces where founders and investors are already beginning to place bets. The infrastructure and API players are particularly interesting, as they enable the entire ecosystem to move faster and more efficiently.

Final Thoughts

From the bustling streets of Mumbai to remote villages in Assam, a quiet revolution is transforming how Indians think about, access, and benefit from insurance. India's insurance industry is no longer just about policies and premiums --- it's about platforms, products, and participation. From urban startups to rural farmers, from embedded commerce to healthtech convergence, the insurance experience is being radically redefined.

What makes this transformation particularly powerful is its timing. It coincides with India's broader digital and economic ascendance—creating a flywheel effect where rising incomes, digital adoption, and innovative protection products reinforce each other.

As insurtechs scale and reinsurers evolve into data-driven partners, the biggest winners will be those who build the trust layer, risk layer, and distribution layer of the ecosystem --- and do it digitally, efficiently, and inclusively.

The ultimate prize isn't just a larger industry or more profitable companies—it's a more resilient India where financial shocks no longer devastate families, where small businesses can take confident risks, and where protection is accessible to all. That's the promise of India's insurtech revolution, and its story is still being written.

We are keenly exploring this space at UNLEASH and would love to talk to you or your known ones, if they are building in the space. Reach out to me at abhishek.kumar@unleashcp.com

Disclaimer – The views presented here are my own and doesn’t reflect views of my employer in any way and it shouldn’t be construed as that in any way whatsoever.

In cars warranty gets nullified with after market device installation. Best way for this would be partnering with manufacturer itself. I am talking in relation to point where you mentioned about insurance premium which can be linked with driving behavior.