RegTech in India: The Large Blue Ocean opportunity rising rapidly | Episode 46

There are multiple areas of interest in the Indian RegTech market and the founders have just started building up here

If there’s one chatter that I have been hearing, it’s around compliance and how there are 350+ (and increasing) startups in the country trying to solve for various use cases. In all fairness, we have also met quite a few of them and there does seem to be some solid areas for innovations here.

While most of the new age companies that gets talked about are those solving for front end, RegTech is the silent enabler of India's fintech boom. It ensures that as financial services scale rapidly, they also remain compliant, secure, and aligned with evolving regulatory frameworks. Even in terms of VC funding and outcomes, this segment has seen some really solid outcomes in terms of M&As resulting in great interest from early-stage investors.

With over 10 billion UPI transactions processed every month, and a fintech adoption rate of 87% (well above the global average of 64%), India is in urgent need of efficient, intelligent compliance mechanisms. That’s where RegTech steps in—leveraging artificial intelligence (AI), machine learning (ML), blockchain, and data analytics to help financial institutions stay on the right side of the law without compromising on innovation.

Let’s dive deeper into the RegTech opportunity in India.

Understanding the Compliance Challenge in the Indian Fintech Ecosystem

Every new financial product or customer touchpoint—whether it’s a digital loan, an insurance policy, or a wealth advisory platform—brings regulatory complexity. The Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), and Insurance Regulatory and Development Authority of India (IRDAI) are constantly issuing new guidelines aimed at consumer protection, data privacy, risk mitigation, and systemic stability.

As discussed in internal circles regularly, traditional compliance systems are no longer fit for purpose. They rely heavily on manual processes, are resource-intensive, and struggle to keep pace with the scale and speed of modern digital financial services. RegTech provides a digital-first alternative—a way to embed compliance into the technology stack itself, making it seamless, scalable, and real-time.

Given RBI’s focus on use of Tech in automating compliances, I see real opportunities for new age startups, especially those focused on use of AI and GenAI to become large enablers in this space. Use cases such as Audits/operations/ documentations as well as the more common ones such as automated regulatory reporting are bound to explode.

Source: A founder building in stealth

India’s Unique RegTech Ecosystem

India’s RegTech journey is fairly distinct from that of Western economies and will evolve on its own path.

While global markets adopted RegTech post-2008 to address financial misconduct and systemic risk, India’s RegTech story is intertwined with its digital infrastructure evolution. Platforms like Aadhaar, India Stack, UPI, and DigiLocker have laid the foundation for real-time identity verification, data portability, and consent-based data sharing. Also, given how conservative and involved RBI has been in the operations of banks and other fintech players, RegTech usage and effects will be more pronounced.

Today, India is home to over 365 RegTech startups, many of which are solving for uniquely Indian challenges such as multilingual KYC, legacy infrastructure integration, and alternate credit scoring. These startups are not just building for India—they're creating exportable models for other emerging markets in Southeast Asia, Africa, and Latin America.

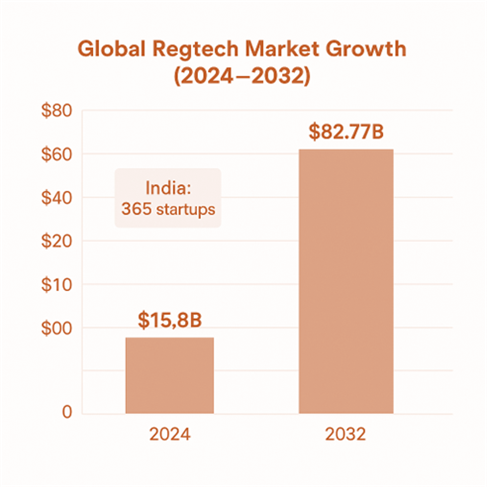

Having said the above, what investors and fintech entrepreneurs can take comfort from is that the global RegTech market is on a steep upward trajectory. From $15.8 billion in 2024, it is projected to grow to $82.77 billion by 2032, at a CAGR of 22.8%. Rising compliance costs (estimated at $213 billion annually) and financial fraud (over $5 trillion yearly) are fueling this growth.

I expect India to be a USD4-5bn market only on the compliance side given the size of our BFSI market and spends in the same. However, India's RegTech firms are solving problems that go beyond global templates.

In India, a successful RegTech platform must support low-bandwidth environments, regional language documents, and unstructured data formats. It must integrate with banks still running on mainframe systems, while also connecting with cutting-edge neobanks and lending apps. This mix of constraints and opportunities is breeding a new generation of hyper-adaptive RegTech solutions.

The multiple use cases of RegTech

As per our conversations with the industry players, there are multiple layers in the value chain where RegTech will becoming increasingly important. Have listed down some of these here.

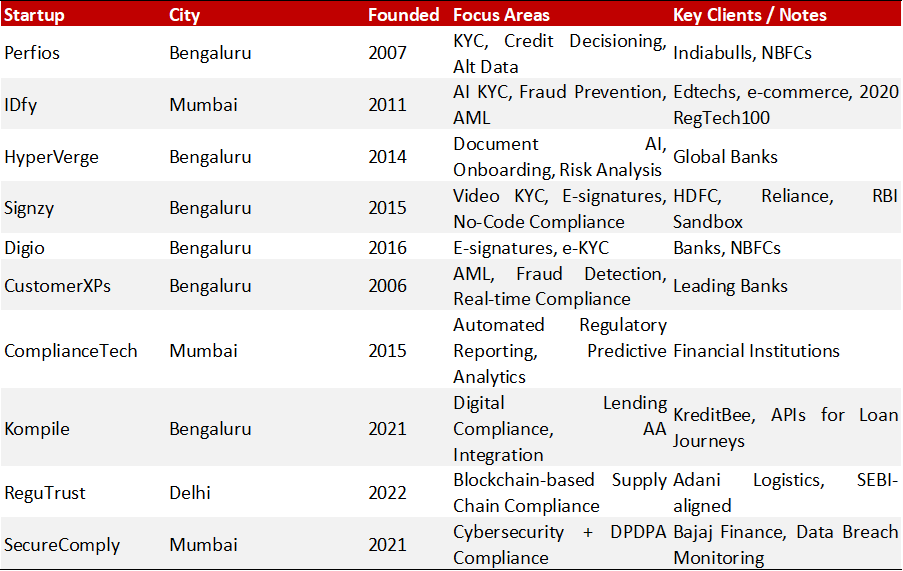

Onboarding & e-KYC Automation: RegTech has dramatically reduced onboarding friction. Startups like Signzy, HyperVerge, and Digio enable e-KYC through AI, facial recognition, and video verification, reducing verification times from days to minutes and cutting costs by up to 50%.

AML & Fraud Detection: With increasing digital financial activity comes higher fraud risk. Platforms like IDfy and Clari5 deploy machine learning algorithms to detect anomalies, assess risk scores, and trigger real-time alerts.

Automated Regulatory Reporting: ComplianceTech and Perfios help automate the preparation and submission of reports required by regulators. These solutions ensure that even rapidly growing fintechs remain audit-ready. Companies like Neurofin are doing great in this area.

Cybersecurity & Data Privacy: SecureComply focuses on helping institutions comply with India’s Digital Personal Data Protection Act (DPDPA), offering real-time breach detection, encryption audits, and data protection dashboards.

Supply Chain Compliance: ReguTrust uses blockchain to bring transparency to supply chain financing, ensuring that documents can't be tampered with and that audit trails are always available.

Credit Scoring for Financial Inclusion: Kompile and Perfios work with alternate data sources—like utility bills, bank statements, and GST filings—to help underwrite borrowers with no formal credit history.

We are actively looking for builders in this space.

In addition, there are regulatory tailwinds helping the cause.

Regulatory innovation is a key driver of RegTech adoption in India. RBI’s 2022 digital lending guidelines mandated clear loan disclosures, borrower consent for data sharing, and bans on unsecured app-based lending without NBFC partnerships. SEBI has pushed for real-time risk monitoring of algo trading, while IRDAI is demanding full digitization of insurance issuance and claim settlement.

Further, frameworks like the Account Aggregator system are setting new standards in consent-based financial data sharing. RBI and SEBI’s regulatory sandboxes are encouraging experimentation, helping startups test novel compliance solutions in controlled environments.

The image below lists down some of the key regulations in the fintech space.

Source: Internet

Form what we have seen, India’s RegTech activity is concentrated in three main hubs:

Bengaluru: Signzy, HyperVerge, Perfios, Kompile, Clari5, Digio. Neurofin

Mumbai: IDfy, SecureComply, ComplianceTech

Delhi NCR: ReguTrust

It does seem like Bengaluru is building for country currently here!

Listing down some of the companies in the space here -

Source: Internet

Case Studies in RegTech Innovation

Perfios helped an NBFC reduce its loan processing time from seven days to just two hours by integrating its data extraction and decisioning engine.

IDfy supported an e-commerce marketplace in reducing fake listings by 25% through its AI-driven document verification tools.

Kompile enabled a fintech client to automate compliance for over 5,000 monthly loan applications, cutting compliance costs by 20% while improving borrower onboarding speed.

An AI based company have been able to reduce the timelines of secured loans from days to <15 minutes!

Rench, a new and upcoming startup with experienced founders, is now solving for treasury management in the debt space.

While KYC/AML and Fraud detection make up more than 60% of current use cases, I expect to see more of operations and audit use cases in the near future which will improve on the efficiencies as well as revenue generating capabilities of BFSI players.

Challenges and the Road Ahead

Despite its promise, RegTech faces several challenges in India, some of which are:

Fragmented data systems and non-standardized APIs hinder interoperability.

High integration costs deter MSMEs from adopting RegTech.

Regulatory uncertainty, particularly around emerging sectors like crypto and AI, creates planning difficulties.

Cybersecurity concerns remain high, especially with the increased sensitivity of financial and personal data.

However, these challenges present new opportunities. Some of the areas where there are clear white spaces are - Multilingual, localized RegTech tools, Plug-and-play compliance stacks for MSMEs, Cross-border RegTech tools aligned with UPI’s international expansion and ESG compliance platforms in anticipation of green finance regulations to name a few.

Newer use cases continue to crop up with increasing use of new technologies and processes which were previously heavily reliant on humans only are now being solved for by using a combination of tech + AI. Exciting times ahead in the space.

Future Trends in Indian RegTech

Looking ahead, RegTech in India will be shaped by several emerging trends. Listing down some of the most talked about ones here -

Adoption of generative AI for proactive compliance monitoring

AI based operations and audit players

Blockchain-based audit trails for real-time assurance

Tools for ESG and climate risk reporting

Expansion into emerging markets with similar regulatory complexity

By 2032, India is expected to contribute significantly to the global $82.77 billion RegTech market, driven by its digital public infrastructure, policy push, and thriving startup ecosystem.

As India marches toward a $1 trillion digital economy by 2030, RegTech will be an indispensable pillar of its financial infrastructure—enabling innovation, ensuring accountability, and building the trust required for sustainable scale.

We are keenly exploring this space at UNLEASH and would love to talk to you or your known ones, if they are building in the space. Reach out to me at abhishek.kumar@unleashcp.com

Disclaimer – The views presented here are my own and doesn’t reflect views of my employer in any way and it shouldn’t be construed as that in any way whatsoever.

like the detailing and insights of the industry. I wonder how the traditional players will get affected by the onset of Gen AI. The pivot will change not only their business model but the entire promise and premise.

Hello Abhishek,

I hope this communique finds you in a moment of stillness.

Have huge respect for your work.

We’ve just opened the first door of something we’ve been quietly handcrafting for years—

A work not meant for everyone or mass-markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where conciousness and judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, vision, patience, resilience and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral.

But it’s a multi-sensory experience and built to last.

And, if it speaks to something you’ve always known but rarely seen heartily expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to experience it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.